Money box saving and teaching kids how to save is an essential aspect of their financial education. As parents, guardians, or educators, it is crucial to help children understand the importance of saving from an early age. Here are some points on how important it is to teach kids how to save, including how to get started and how to keep saving.

- It builds good financial habits

Teaching kids how to save from an early age helps them develop good financial habits that will stay with them for life. Children who learn to save and budget their money tend to become financially responsible adults. By instilling good financial habits in children, they will be better equipped to manage their finances in the future.

2. It teaches delayed gratification

Saving money requires patience and delayed gratification. Children who learn to save understand that they cannot have everything they want immediately. This helps them develop patience and self-control, which are important life skills.

3. It promotes financial literacy

By teaching kids how to save, you are also promoting financial literacy. Children who learn how to save money also learn about budgeting, interest, and the concept of compound interest. Financial literacy is essential for kids to make informed financial decisions in the future.

4. It helps children set financial goals

Teaching kids how to save helps them set financial goals. Whether it is saving for a toy, a bike, or a college education, children learn to set goals and work towards achieving them. Setting and achieving financial goals teaches children about hard work, determination, and perseverance.

5. It prepares children for financial emergencies

Saving money is not only about achieving financial goals but also preparing for financial emergencies. By teaching kids how to save, you are also teaching them to prepare for unexpected expenses, such as car repairs or medical bills.

Now that we understand why it is important to teach kids how to save, here are some tips on how to get started and how to keep saving:

a) Start early

The earlier you start teaching kids how to save, the better. Children as young as three years old can understand the concept of saving money. Start by giving them a piggy bank or a jar to save their coins and bills.

b) Set an example

Children learn by example. Set a good example by saving money yourself. Explain to your kids why you save money and how you save money.

c) Make it fun

Saving money can be fun for kids. Set up a savings goal chart and reward your child when they reach their goal. You can also encourage them to save by matching their savings or giving them a bonus for achieving their goals.

d) Teach them about interest

Teach your kids about interest and the concept of compound interest. Explain how interest can help their money grow and why it is important to save money in a bank account that earns interest.

e) Encourage saving for long-term goals

Encourage your child to save for long-term goals, such as college education or a down payment on a house. Explain to them the benefits of saving for the future and how it can help them achieve their dreams.

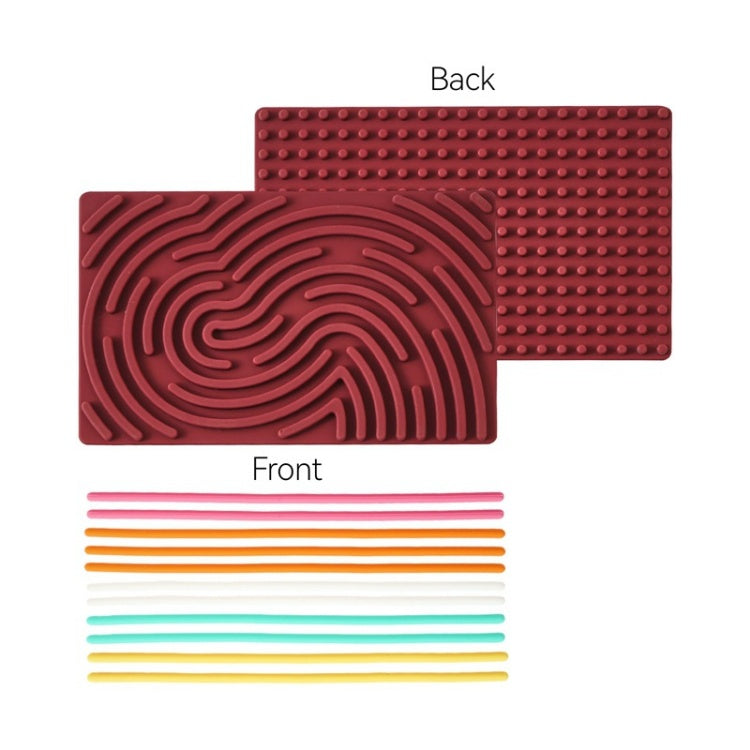

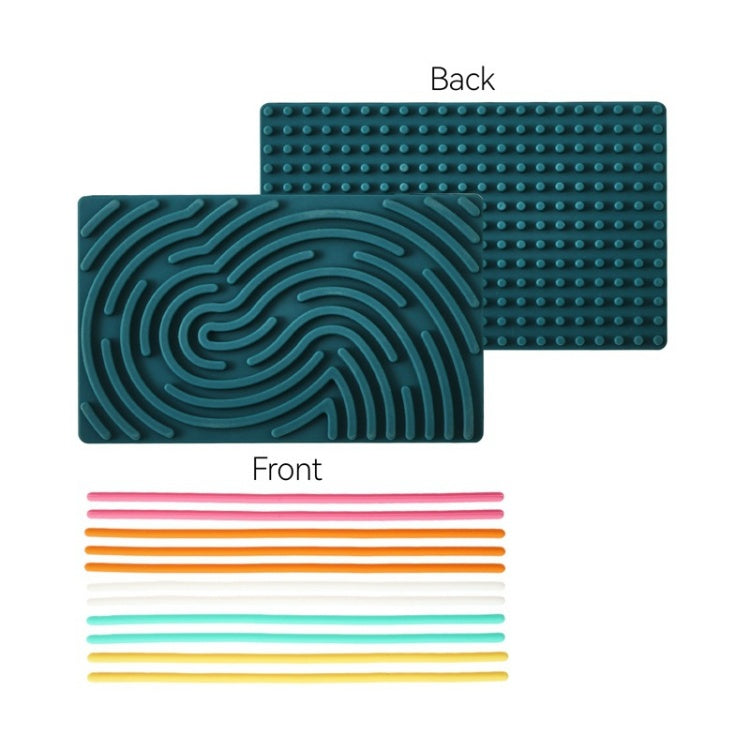

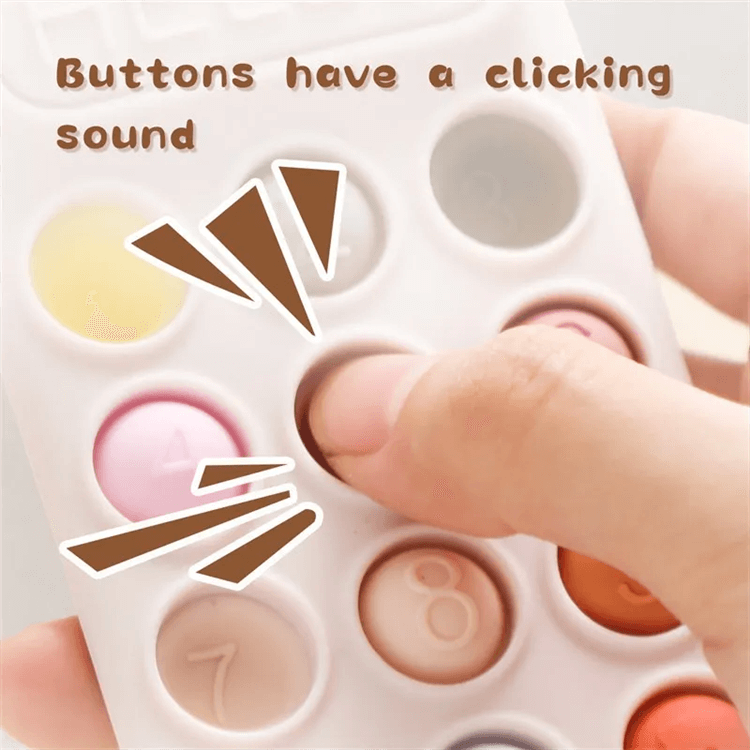

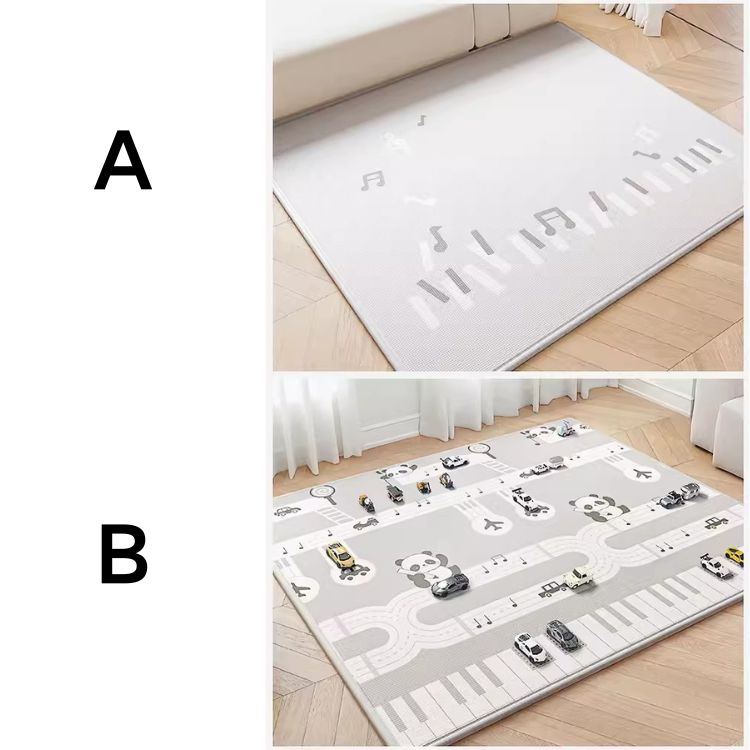

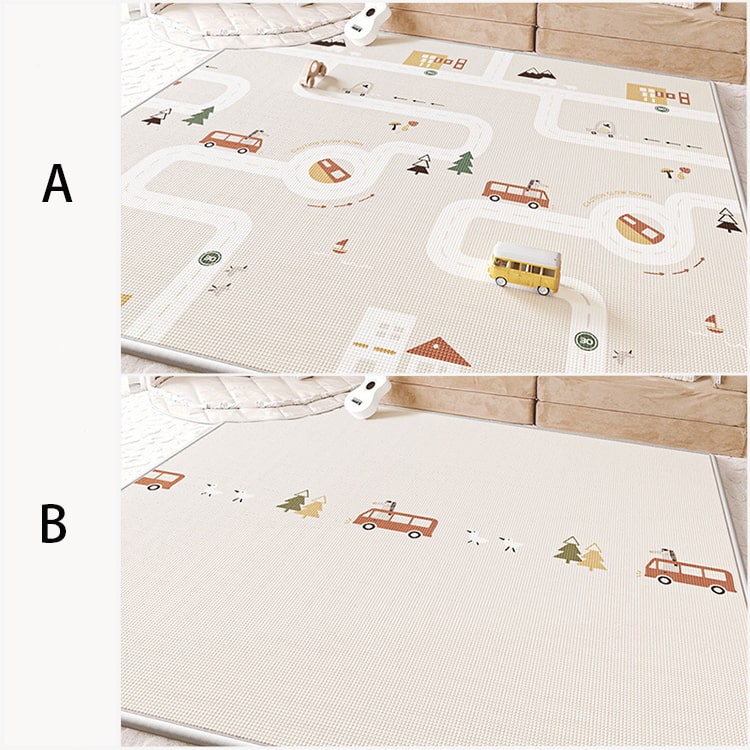

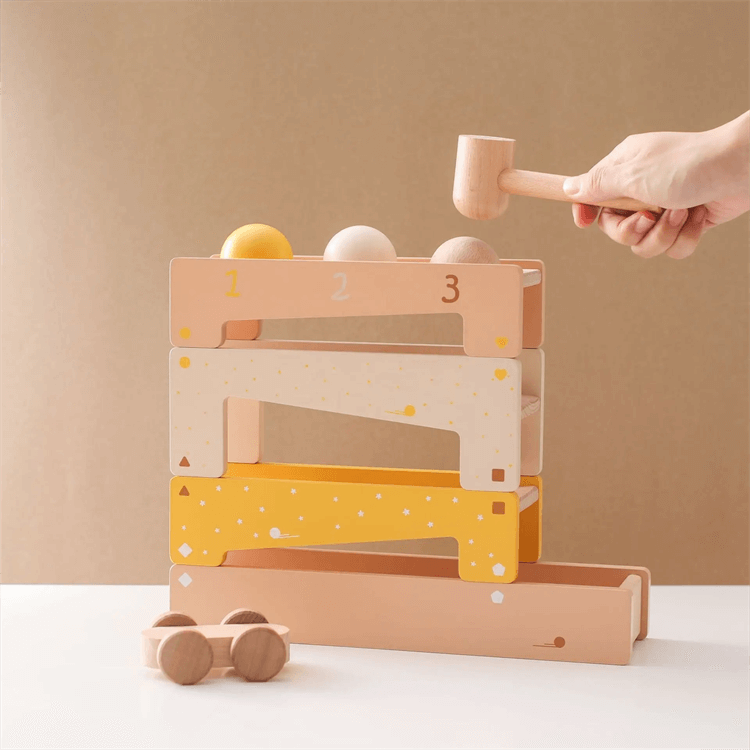

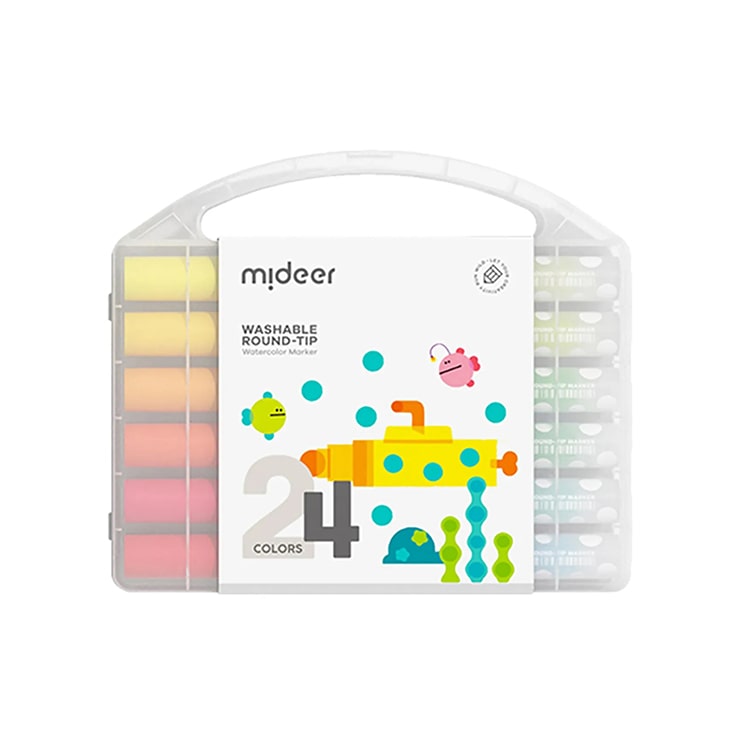

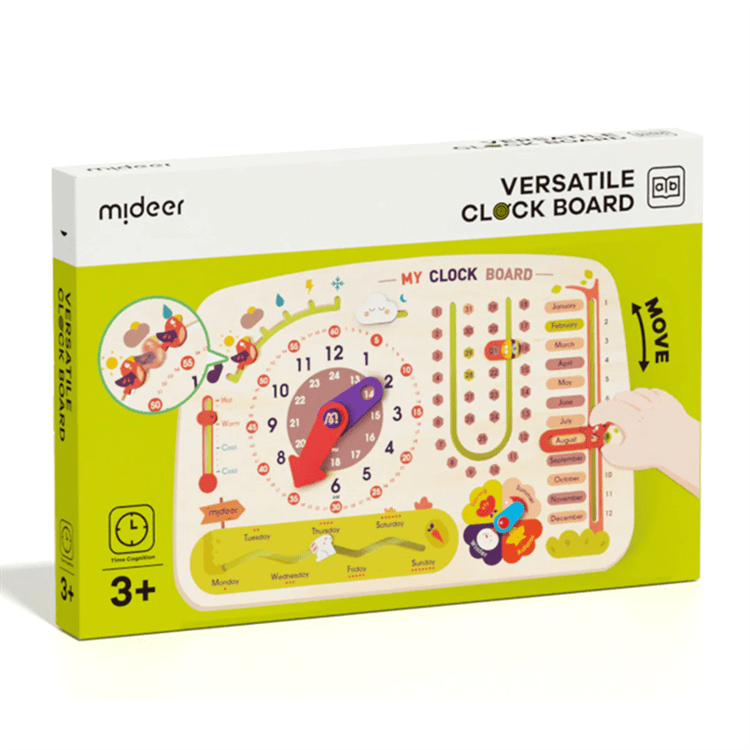

iKids have some lovely moneybox options.

Teaching kids how to save is essential for their financial education. It helps build good financial habits, promotes financial literacy, teaches delayed gratification, prepares children for financial emergencies, and helps children set financial goals. By following these tips on how to get started and how to keep saving, you can help your child develop a healthy relationship with money that will last a lifetime.